If you own a business or lead an organisation do you ever wonder:

- Is my organisation ready and positioned for whatever is next?

- I barely have time to do everything I need to do now – I’m stretched too thin, but I can’t afford for anything to go wrong – how can I have better comfort that things are not slowly drifting off course?

- I can’t be everywhere at once – I wish I could have a better view of my business to identify hotspots or areas that need closer attention,

- If X happened, would we be ready to deal with it?

- If something has gone wrong, are we fixing it properly, fully and making sure that we learn from the experience so that it doesn’t happen again?

- I know that there are risks in business, but am I adequately protected against them?

- Do I understand the risks I face in my business and the competitive environment we are operating in?

Why is Risk Management important?

1. Financial Protection: Small and medium businesses often have limited resources, making them more vulnerable to financial losses resulting from unforeseen events such as natural disasters, economic downturns, or legal issues. Effective risk management helps to mitigate these financial risks and protect the business’s assets and financial stability.

2. Business Continuity: Identifying and addressing potential risks in advance allows small and medium businesses to develop strategies to maintain operations even in the face of adversity. This ensures business continuity, which is essential for maintaining customer relationships, preserving market share, and sustaining revenue streams.

3. Regulatory Compliance: Small and medium businesses are subject to various regulations and compliance requirements, which can carry legal and financial consequences if not managed properly. Effective risk management helps ensure that the business complies with relevant laws and regulations, reducing the risk of non-compliance penalties and legal issues.

4. Reputation Management: Reputation is crucial for small and medium businesses, as it impacts customer trust and loyalty. By managing risks related to product quality, customer service, and ethical practices, businesses can protect their reputation and brand image.

5. Competitive Advantage: Proactively managing risks can give small and medium businesses a competitive edge by demonstrating a commitment to sound business practices, quality assurance, and operational resilience. This can be a differentiator in the marketplace and enhance the business’s attractiveness to customers, partners, and investors.

6. Long-Term Sustainability: Small and medium businesses that effectively manage risks are better positioned for long-term sustainability and growth. By identifying and addressing potential threats, they can avoid costly setbacks and position themselves to capitalize on opportunities as they arise.

7. Data Management: Perhaps one of the least considered risks by any business is that of data management – making sure they have the right data, of the right quality, in the right place and at the right time. Failure to do this and to understand where and how data could potentially be misused or event lost from your business could result in serious errors in decision making, which could harm almost every other aspect of risk concern.

Why should risk management matter to you?

All businesses are exposed to risk and good risk management can act like a dashboard to keep your business on track to achieve your goals to stay disciplined and to stay safe. Good risk management can be that block that stops a chain of events from becoming a catastrophe or puts in place the systems to fall back on that protect you when things start going wrong. As a business owner you can’t always be in all places at once and so you rely on your staff to perform duties or make some decisions for you. But how can you be sure that the level of risk they’re willing to take doesn’t leave you more exposed than you’re comfortable with?

This is where concepts like risk frameworks, risk profiles and risk culture become extremely important to successful businesses – particularly those that are growing to a point where the owner is becoming more of a manager than a doer – or where the business is taking on investors, developing a proper Board of Directors and needs to be able to demonstrate to them that the business is being responsibly run.

Outsourced risk management

In many large organisations, like banks and insurance companies, risk management is very visible, requiring large teams and significant reporting effort, but it’s not only those large organisations that should put some effort into managing risk and it doesn’t require the same footprint in all businesses. This is where Risk Strata’ can help. Although risk management requires a deep insight into all aspects of the operations of an organisation, our outsourced risk management model can help tailor that approach to the needs of any organisation and spread the cost burden for smaller organisations.

The benefits of good risk management are not just for businesses; however, it really does extend to any situation where there is a degree of separation between operations and governance. This could include schools and school boards, charities and not-for profits, sports clubs, community groups or even religious organisations like churches.

Benefits of good risk management

The benefits of good risk management to your business can be far greater than you imagine:

- Better visibility of incidents and issues to improve your business over time,

- Better and more consistent decision making through clearly defined operating parameters,

- Happier and more productive staff as they have greater certainty in what is expected of them, the longevity of their roles, the safety of the environment within which they are working,

- Happy customers who may drive repeat business as they have greater confidence in the quality of the work you do and they have greater confidence that you will be around for longer in the event that anything does need to be fixed,

- Regulators may have more confidence in the controls you have in place to ensure you meet your compliance obligations which could reduce reviews or inspection frequencies or resources required,

- Banks and investors have more confidence in financing your business because they can see greater depth in your business, a rigour in your controls and can be confident that you can stick to any covenants or conditions they may impose and know that you can keep their investments safe.

Starting with your risk profile

A small business’s success depends on various factors, and understanding its risk profile is crucial for making informed decisions and managing potential challenges. A risk profile refers to an assessment of the potential risks and rewards associated with a business’s activities, and having a good understanding of it offers several key benefits to small businesses.

First and foremost, a good understanding of the risk profile enables small businesses to make informed strategic decisions. By identifying and assessing potential risks, such as market volatility, industry-specific challenges, or competitive pressures, business owners can develop comprehensive strategies to mitigate these risks. Whether it involves diversifying products, entering new markets, or adjusting pricing strategies, a clear understanding of the risk profile provides valuable insights that help in formulating effective business strategies. This, in turn, can lead to sustainable growth and improved long-term performance.

Furthermore, an in-depth comprehension of the risk profile empowers small businesses to make sound financial decisions. By recognizing potential financial risks, such as cash flow challenges, debt obligations, or economic downturns, business owners can take proactive measures to manage these risks effectively. For example, they can establish financial reserves, secure lines of credit, or adjust their investment and capital allocation strategies to safeguard the business’s financial stability. Understanding the risk profile helps in optimizing financial resources and ensuring the business’s resilience in the face of unforeseen economic challenges.

Moreover, a good understanding of the risk profile enhances a small business’s ability to secure financing and investment. When seeking funding from banks, investors, or other financial institutions, a well-documented understanding of the business’s risk profile demonstrates a proactive and responsible approach to risk management. This can instil confidence in potential lenders or investors, making the business a more attractive investment opportunity. Additionally, a clear risk profile can facilitate transparent communication with stakeholders, enabling them to make informed decisions about providing financial support to the business.

In addition, a comprehensive understanding of the risk profile contributes to the development of effective risk management strategies. Small businesses can proactively identify, assess, and prioritize risks, allowing them to implement risk mitigation measures and contingency plans. This might involve acquiring insurance coverage, implementing robust cybersecurity measures, or establishing internal controls to minimize operational risks. By addressing potential risks before they escalate, businesses can minimize the likelihood of financial losses, operational disruptions, and reputational damage, thereby enhancing their overall resilience.

Furthermore, a good understanding of the risk profile promotes a culture of accountability and responsibility within the organisation. When employees at all levels are aware of the potential risks that the business faces, they are better equipped to make informed decisions and take appropriate actions to mitigate these risks in their respective roles. This heightened risk awareness fosters a more conscientious and proactive approach to day-to-day operations, leading to improved operational efficiency and a reduced likelihood of costly errors or oversights.

Ultimately, a good understanding of the risk profile contributes to the overall sustainability and longevity of a small business. By acknowledging, analysing, and managing risks effectively, businesses can adapt to changing market conditions, capitalise on opportunities, and navigate challenges with greater confidence and agility. This proactive approach to risk management not only safeguards the business’s assets and reputation but also positions it for long-term success and growth in an increasingly competitive business environment.

What’s in it for you?

We can help you improve your visibility and understand of the organisation you are leading. This includes improving your understanding of the vulnerabilities your organisation may face, the controls you can put in place to help protect against those vulnerabilities and how to communicate appropriate settings to help other decision-makers in your organisation stay within limits.

This will give you peace of mind so that you can stop worrying about the little things and focus on the big picture to lead your organisation to achieve the greatness you deserve.

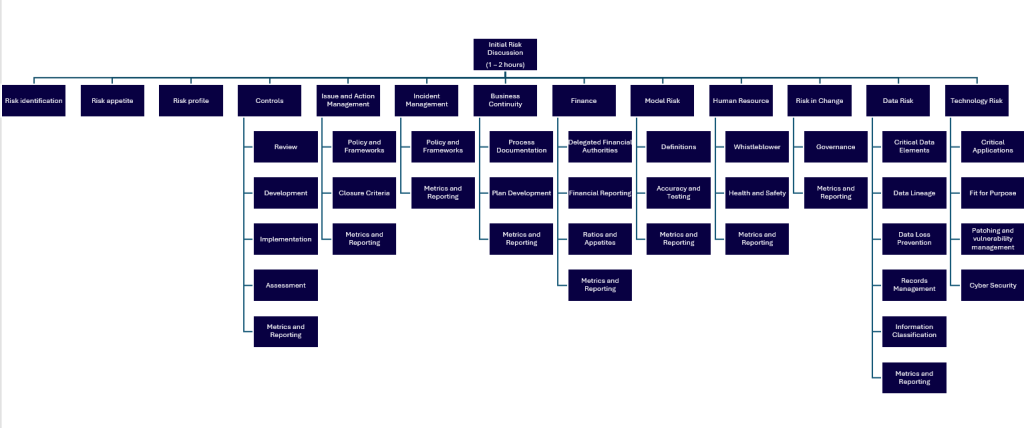

What does a journey with us look like?

A risk journey can go in many different directions and can be as complex or as simple as you need it to be – and we can help you navigate all that complexity.

All our engagements start with a free, no obligation discussion to understand your specific concerns and to prioritise the services that will provide you with the most comfort in the least amount of time. These can be built up into a wide-ranging risk engagement including the wholesale outsourcing of a Risk Management office for your organisation.